Digital design has become the primary way people interact with products and services and manage complex texts. As users’ expectations are rising, it is important to create frictionless designs that streamline the interactions. This makes user experience an integral element in the success of modern products and services.

The significance of UX design is particularly important for financial products, where users are performing complicated tasks that can have higher risks. Therefore, in fintech, good UX design is related to trust and security, along with ease of use.

In this article, we explore the relationship between UX design and fintech. We discuss the core principles of fintech UX design, its best practices, and the emerging trends and challenges.

Read along as we share important insights about fintech UX design.

Introduction: Why UX Matters in Fintech

In financial products and services, UX design directly impacts users’ trust, satisfaction, conversion rates, and retention over the long term. With several alternatives available to users, it is important to provide simple, reliable solutions for financial management. Fintech UX can directly shape users’ feelings and attitudes from the first interaction.

UX design in fintech is not just about adding visual appeal. Good UX enhances the overall user flow, reduces errors, and prevents costly mistakes. This then leads to increased confidence, thus making design a critical part of the user journey and brand image.

It is also important to note that managing finances and making complex financial decisions involve an emotional element. Users experience a range of emotions, including fear, excitement, and anxiety. UX design is perfectly positioned to acknowledge and address these emotions, thereby reducing uncertainty and stimulating trust in the user journey.

What Is Fintech UX Design?

Fintech UX design refers to the practice of designing user experiences for financial products and services, such as banking applications, payment platforms, investment tools, crypto products, and decentralized finance (DeFi) systems. Fintech UX design focuses on the financial actions and decisions the users can take through digital interfaces.

What is fintech UX design?

Fintech UX design is the design of user-friendly financial products that aim to make complex tasks, such as banking and investing, simple and easy. Fintech UX design brings the fundamental principles of design along with a deep understanding of finance to design a better experience.

The goal of fintech UX is to make complex financial operations understandable, predictable, and safe for everyday users. In fintech, a good experience would help users accomplish their tasks with confidence instead of hesitation or frustration. Fintech UX does not just focus on visual appeal and aesthetic elements. Instead, it prioritizes clarity, transparency, and reliability throughout the interaction.

Providing accurate and clear information to the users, keeping them in control, and saving them from any mistakes are some of the guiding principles of fintech UX design. This is why many organizations choose to work with a specialized UX design company that understands financial aspects and user trust.

Fintech UX vs UI Design

When it comes to the design of fintech products and services, UX and UI serve different roles. UI vs UX reflects the difference between how a design looks and how it functions. The former focuses on visual elements, such as layout, color, and branding, while the latter is concerned with the overall user journey, behavior, and error handling during the interactions.

While UI has its significance in fintech, the value of UX is even higher. An overwhelming or confusing user flow can lead to massive financial errors, such as incorrect transactions or irreversible investments. Since the stakes are quite high, it is important that designs focus more on functionality instead of the visual appeal. Strong fintech UX would not just provide a satisfying user experience, but also safeguard the users against costly errors.

Core Principles of Fintech UX Design

When designing for fintech solutions, it is extremely important to focus on building trust, giving control to users, and mitigating risks. Every interaction must prioritize user safety and comfort, while giving them the best experience. These principles are not just recommendations. Instead, for fintech UX design, these are non-negotiable requirements that have a long-lasting impact.

What are the core principles of fintech UX design?

The core principles of fintech UX design are as follows.

- Trust, transparency, and security

- Simplicity in complex financial flows

- Error prevention and user control

- Accessibility and inclusive design

- Cross-platform UX consistency

The core principles of fintech UX design are discussed below.

Trust, transparency, and security

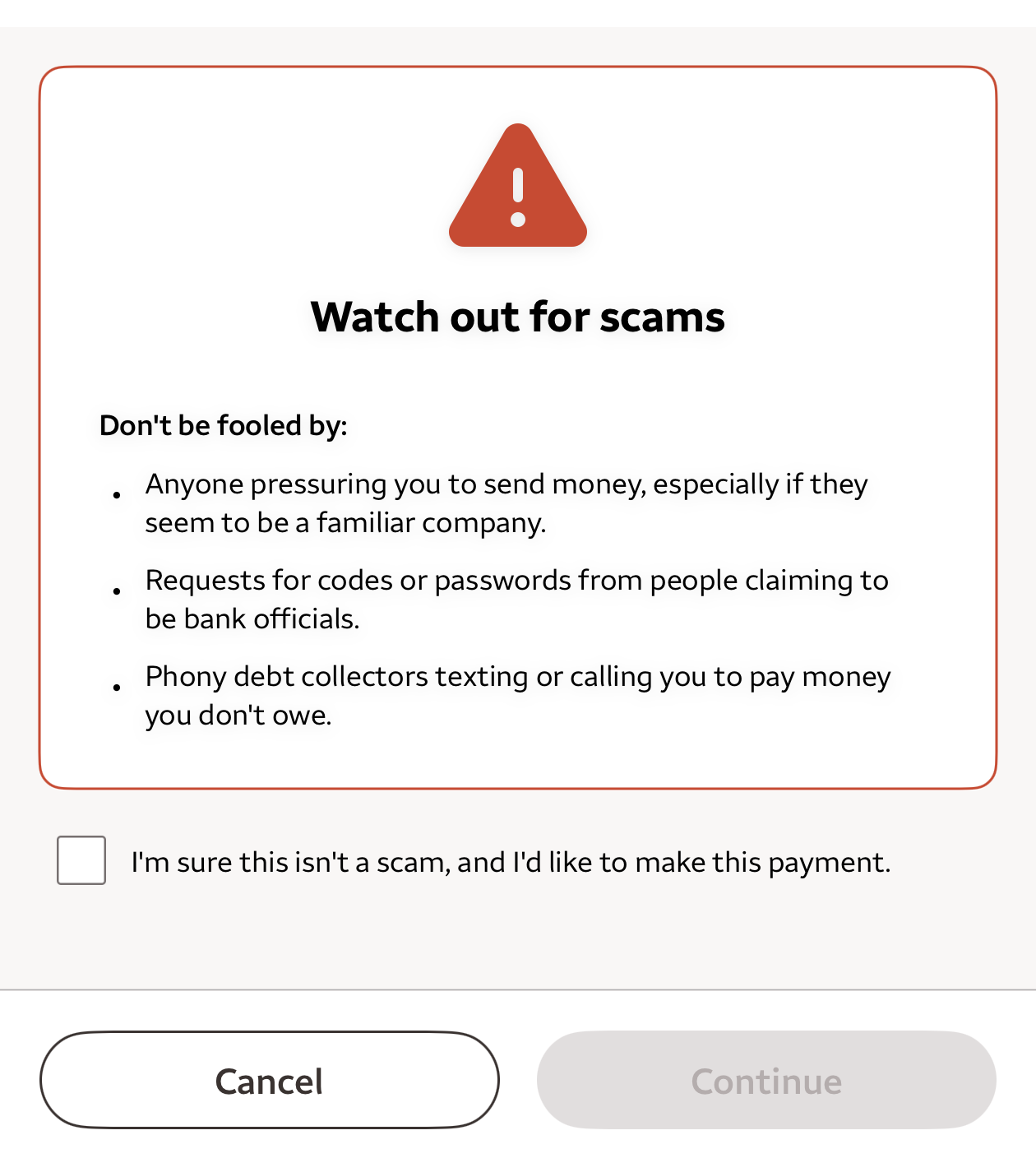

Security is one of the most important requirements for any fintech product or service. Designers must signal security at every critical step and make these security decisions visible. It is important to give clear indications to users about their security, reassuring them that their data is protected, and warning them of any errors or missteps.

When it comes to transactions, the status must always be clearly displayed. Important information, such as fees, timelines, and risks, should be disclosed upfront. Any hidden information directly violates trust, leaving a bad impact on the user experience.

Simplicity in complex financial flows

Financial processes can be complicated. There is a lot of technical information that the users might not understand. Therefore, designers must break the complex information down for the audience. Processes such as transfers, Know-Your-Customer/Client (KYC) and other identity verification protocols, and investments should be explained and presented in a simple manner.

Providing clear and unambiguous information helps reduce the cognitive load, saving them from errors and confusion. Users should always be aware of the processes and how they impact them, without having to worry about the complex technical details.

Error prevention and user control

Error prevention and user control are important user heuristics. Its significance gets even more pronounced in fintech UX design, where users perform complex, at times irreversible, operations. Therefore, the design should be such that it prevents errors and displays clear warnings.

Focus on Prevention and Security

Similarly, giving more control to users is also critical. Fintech UX design should provide users with the options to easily review, confirm, pause, or cancel their actions. This control will lead to less fear and more trust.

Accessibility and inclusive design

Digital financial products and services are for a wide range of audiences with varying physical and cognitive abilities. Designers should strictly follow WCAG standards and not treat them as an afterthought. Important considerations, such as the use of contrast and choice of accessible fonts, should be built into the design.

Additionally, the financial literacy of the audience of a fintech UX design also varies significantly. Designers must take these needs of their target audience into consideration. Fintech UX design should use plain and simple language that is understandable by beginners and experts alike.

Cross-platform UX consistency

Users interact with fintech products and services through different mediums, including mobile apps and websites. It is important that fintech UX design is consistent across platforms. This can be achieved by using the same terminologies and branding, and ensuring consistent user flow irrespective of the medium.

Familiarity is the key to building trust. Therefore, when designing a fintech product, it is important to provide users with a familiar experience that they do not have to relearn every time the platform changes.

Best Practices for Fintech UX Design

Along with the core principles of fintech UX, there are some best practices that can guide the design process. These best practices are drawn from real-world examples and the impact of fintech design decisions on the overall user experience.

What are the best practices for fintech UX design?

The best practices for fintech UX design are listed below.

- Clear onboarding and progressive disclosure

- Financial data visualization

- Contextual in-product education

- UX writing and microcopy

- Frictionless security UX

Some best practices for fintech UX design, focusing on the execution and delivery of quality designs, are as follows.

Clear onboarding and progressive disclosure

Good fintech design is one that guides the users in a step-by-step manner, particularly during their first interaction. Financial designs can be tough to navigate, and onboarding tutorials can be really helpful.

Good tutorials are the ones that leave advanced details for later and deliver information in a sequential manner. Such tutorials save the users from being overwhelmed, thus making the design more user-friendly.

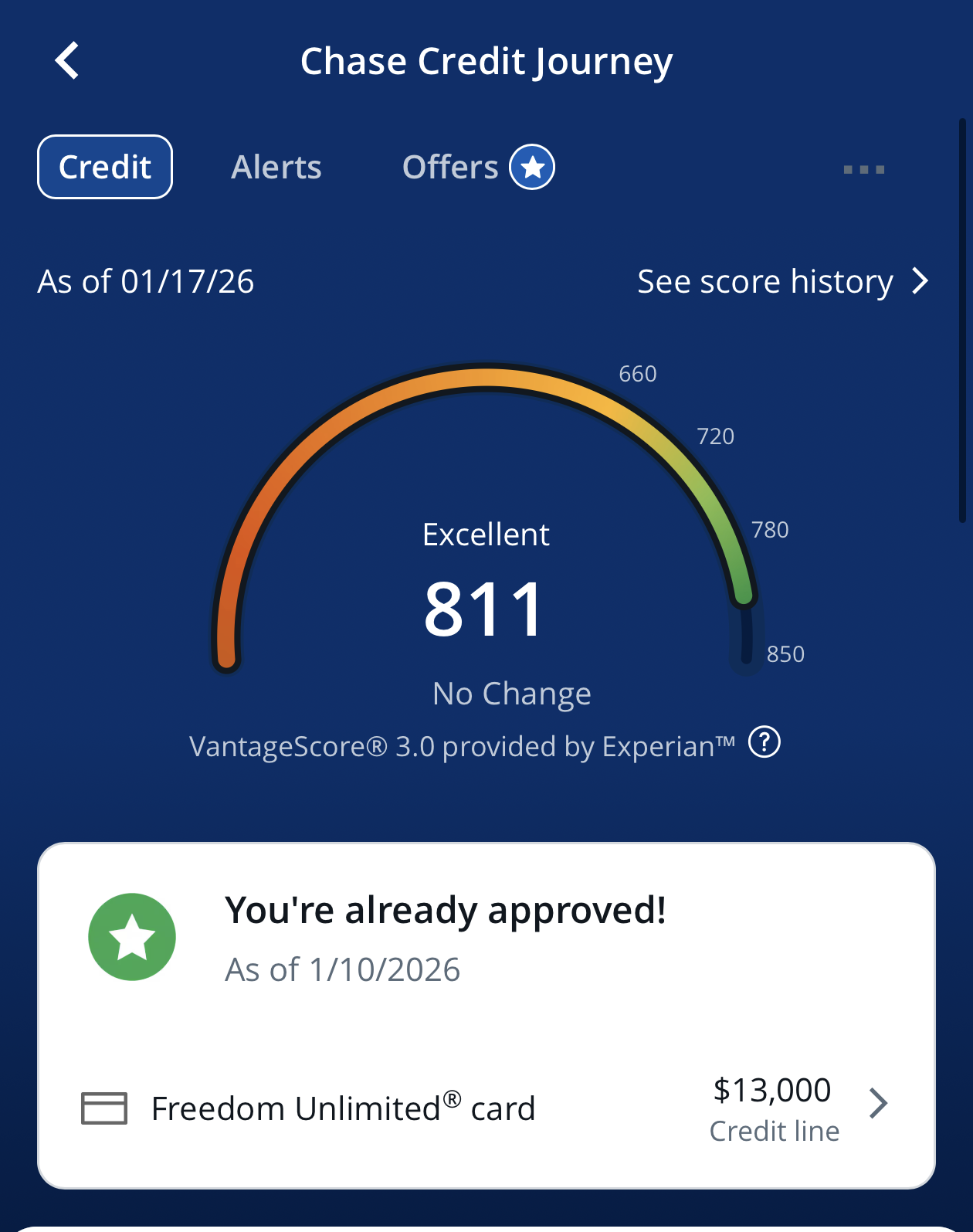

Financial data visualization

Financial data is complicated, and it is not easy to understand with the help of words and numbers alone. The use of visualizations, such as charts, figures, and interactive dashboards, can help users understand complex information in a simple manner.

Visualizing Financial Data

It is important to present information that can guide better decision-making, instead of merely reporting the numbers. The visuals should add value to the user journey, instead of being solely decorative.

Contextual in-product education

Fintech UX designs work best when they provide scaffolding to the users where necessary. It is important to educate and inform the users during their interactions, so they can make informed decisions.

Designers can rely on tooltips, brief explanations, and subtle hints to explain complicated concepts and interactions in the user journey. However, it is important to provide this information such that it does not disrupt the user flow.

UX writing and microcopy

The use of simple, clear, and easily understandable language is critical for fintech UX design. UX writing and microcopy should avoid financial jargon and complex terms. The writing should be more human-centered, where the focus is on making the information understandable and usable to the target audience.

Frictionless security UX

Another best practice of fintech UX design is the integration of security measures in the design process. Services such as two-factor authentication (2FA), biometrics, and identity verification are critical for any financial product or service.

However, it is important to incorporate these measures in a way that does not cause interruptions in the user journeys. Designers should save the users from repetitive input of information and unnecessary disruptions.

Fintech UX Trends for 2026

Fintech UX design is always advancing. The year 2026 brings its own trends and strategic shifts that design teams must prepare for. The focus now is shifting more to changing user expectations around control and clarity.

What are some trends in fintech UX design to look for in 2026?

In 2026, some fintech UX trends to keep an eye on are as follows.

- AI-powered personalization

- Embedded finance and invisible UX

- Voice and conversational interfaces

- Open banking and consent UX

- Privacy-first UX design

For any UX design agency working in fintech, the following trends signal where design must evolve to stay relevant and credible.

AI-powered personalization

AI-driven personalization is making its way in the world of fintech UX design just like any other field. With the help of AI, designers can tailor user experiences by personalizing dashboards, providing helpful insights, and giving useful recommendations. However, designers need to ensure transparency in this personalization and ensure maximum user control.

Embedded finance and invisible UX

Financial actions are now getting embedded into non-financial products. Fintech UX design is shifting away from explicitly exposing users to banking moments. Instead, financial decisions are becoming more native to non-financial products and services. Designers will have to create seamless integrations and avoid complexities.

Voice and conversational interfaces

Chatbots and voice assistants are quickly replacing the conventional approach to banking, particularly when it comes to customer support. Fintech UX design needs to prioritize chat-based and voice-based interactions. It is critical to keep these interactions simple, so this multimodal approach does not add complexity to the user experience. Additionally, the users should have the option to switch between different modes when accomplishing their tasks.

Open banking and consent UX

Open banking requires that users understand how data-sharing works, and they have full control over their data. Therefore, designers have to not only make data-sharing processes understandable and transparent, but also ensure that consent is built into the process. This is another aspect where good UX writing and the use of simple language are necessary.

Privacy-first UX design

Similar to any other digital product or service, privacy is becoming a core component of fintech UX design. The privacy and security of users’ information and their consent should no longer be treated as add-ons or good-to-haves. Instead, such information must be made clearly available to the users, so they can make informed decisions.

Fintech UX Design Challenges

Fintech UX design is not free of challenges. There are several tensions and tradeoffs that designers need to consider for financial products and services. Considering these challenges can help design better solutions for the audience. Some important challenges in fintech UX design are as follows.

Compliance vs usability

Fintech UX design must stick to compliance standards, which can be challenging. Some constraints can clash with the design requirements. Designers need to navigate this challenge carefully to ensure that the user experience is not compromised.

High-Stress financial scenarios

It can be challenging to design for stressful financial scenarios and challenges, such as blocked accounts, fraud alerts, and denied transactions. In such situations, UX must avoid blaming the users. Instead, the focus should be on the use of calm language and rectification of the issue.

Communicating risk and uncertainty

Financial decisions are never free of risks and uncertainties, and designing for such situations is not easy for fintech UX. However, this is one aspect where the appropriate use of visuals and warning messages can come in handy. Designers should not manipulate or misinform the users. Instead, they should report concerns with honesty to gain users’ trust.

Scaling UX across markets

When designing for the digital space, it is important to think about the concerns of the global audience. Designers should localize fintech products, and incorporate the needs of different cultures and regions. This also includes giving due attention to regulations in different regions, along with the financial habits and lifestyles of people.

Conclusion: Fintech UX as a Competitive Advantage

In fintech, UX design directly impacts the growth, retention, and long-term reputation of an organization. Products that are easy to use, reliable, and respectful gain trust faster and retain users over a longer timeframe. Thus, UX becomes a strategic advantage, not a cosmetic layer, in fintech.

Good fintech design relies heavily on trust, clarity, and user control. When users feel confident and protected, they are more likely to use the product and also recommend it to others. In fintech, UX is not just part of the product — UX is the product.

Jan 29, 2026