Do you know that 20% of new businesses fail in their first year, according to the Bureau of Labor Statistics (BLS) in the U.S? Many factors influence that. Still, lack of fundraising is one of the most common reasons for a venture's downfall, says Harvard Business Review.

How can we secure much-needed money and support for the critical, turbulent first year with millions of startups competing in the sector? The answer lies in a successful investor pitch deck that tells your story, piques the interest of potential customers, and attracts investment. Its clear, structured, meaningful, informative, and compelling delivery helps startups overcome their first obstacle: finding reliable partners to launch the product and begin conquering the market.

What is a startup pitch deck, what does it include, and how can it be effective? Follow our guide to get the answers.

What Is a Pitch Deck and Why Startups Need It?

A startup pitch deck is a short yet clear, structured, meaningful, and compelling presentation of the new marketing idea or business. It includes no more than 20-25 slides that help the audience understand the story, vision, mission, values, offer, proposition, and business plan. Depending on the ultimate goal and market segment, it might also include the problem, solution, product, team, business model, and financial projections.

As a powerful marketing tool, a startup pitch deck is essential for making a first impression that lays the foundation for fundraising, attracting investors, and generating interest in the business idea. Created with the help of a professional startup branding agency, it secures the follow-up meeting and convinces clients or potential investors to enter into a partnership.

Key Slides Every Winning Pitch Deck Should Include

To create a pitch deck that turns a simple idea presentation into a powerful marketing tool, companies must have slides that draw the audience into a compelling, meaningful, and convincing storytelling experience with impactful first and last impressions. Here is what the structure of every successful startup pitch deck looks like.

Company vision and value proposition

The first slide is always responsible for the first impression; therefore, it must be perfect to build momentum for a positive reaction and a desire to learn more about the company. It centers around the "Why does this matter?" question.

The best way to answer this is to introduce your company and its vision, mission, values, goals, and value proposition. It would also highlight the team's expertise, skills, and knowledge to demonstrate how the new idea can change the market.

The problem you're solving

To build on the momentum, it is highly recommended that the next slide draw listeners' attention to the problem your startup is eager to solve. Conduct thorough market research and organize data into digestible sections to effectively demonstrate customer pain points through examples, statistics, and stories.

Use this slide from the pitch deck to show that the problem is real and urgent. Prove that you are not just a vendor but a partner who helps solve this challenge, and have a strong basis to monetize the solution, thereby turning it into an attractive investment.

The solution and how it works

After identifying a market gap, the next step is to ground your product in real-world needs, making it relatable to customers, and showing its potential for monetization through its value proposition and competitive advantage.

It is crucial to stay clear, concise, and informative to ensure your audience understands your solutions thoroughly and their key features and benefits. Therefore, populate this slide with a meaningful yet straightforward explanation of the product and its innovative side, and list its unique characteristics and advantages over others.

Product: demo, prototype, or screenshots

The fourth slide focuses on the product and the brand's value proposition to make the pitch and the idea more relatable to potential investors, customers, and real market needs.

A popular strategy is to show the actual product through visuals. Do you have screenshots, a demo, or an MVP? Everything proves its validity, credibility, and value. Use high-quality visuals or short videos to show the solution in a real-world setting, demonstrate its capabilities, and make it tangible and beneficial through its unique features.

Traction: metrics, milestones, and social proof

Tracking your product is essential, as it provides real-time insight into its efficiency, validity, value, market positioning, and knowledge for optimization and improvement. With the so-called "traction slide", your startup must demonstrate your understanding of this necessity and ways to handle it.

However, do not overwhelm your listeners with a too-detailed tracktion routine. Highlight key factors, including KPIs, milestones, deadlines, growth metrics, and user data. This helps avoid confusion and convinces investors that the venture is a wise investment, with risks your company anticipates and is eager to handle. It would also include social proof, such as press coverage, testimonials, and potential partnerships.

Market size and growth opportunity

Showing market size is a great way to prove to potential investors the value, validity, and relevance of your solution, demonstrate the potential for monetization, and give them a solid foundation for investment.

By presenting TAM (the entire market demand for a product), SAM (the portion of TAM a company can realistically target), and SOM (the portion of SAM that could be realistically captured with the startup's current resources) clearly through visuals and data, your company proves to the audience that there is a significant and scalable growth opportunity to generate substantial returns for investors and turn your business into a long-lasting brand with an ability to cover not only the local segment but also international one.

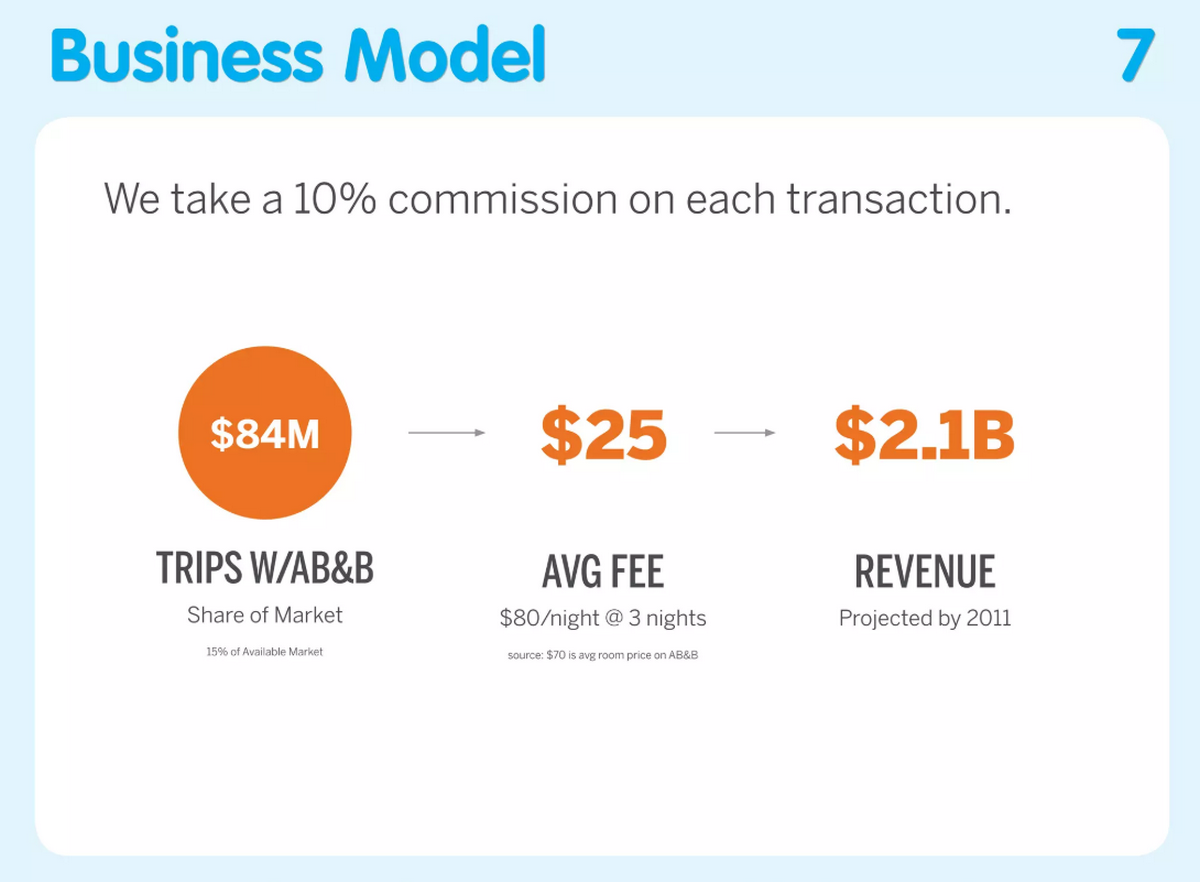

Business model: how the startup makes money?

The following slides focus on the business plan, which is crucial for fundraising. It serves as a roadmap for daily operations and demonstrates the understanding of what it takes and how much money is needed to bring the idea to market.

Start with short and long-term goals, revenue streams, and monetization strategy. Show how you will align your teams and manage risks; what a framework you have for making strategic decisions, and running your business smoothly and efficiently. Highlight simplicity, repeatability, and profit drivers, and prove your thorough understanding of the financial and operational sides.

Competitive analysis and market landscape

Every startup must undertake an in-depth, independent competitive analysis to understand the landscape. This stage provides knowledge for making well-considered decisions, identifies opportunities, minimizes risks and threats, and builds a sustainable competitive advantage.

As with the "traction side," do not overwhelm your audience with too much data or statistics. Prioritize vital information and use smart tools to present it through graphs and visuals. Map competitors and differentiation points, and prove to potential investors that your market understanding and unique position are well-grounded.

Go to market strategy

A GTM strategy is a cornerstone of every successful startup. It is a plan to launch the product, reach the target market segment, and gain a competitive advantage. To compel your investors to partner with you, you must demonstrate a well-elaborated GTM strategy.

Use a presentation slide to briefly outline your customer acquisition plan, identify the core promotion tactics, list the channels, and note possible partnerships with other companies or influencers to advance your product. Ensure every element of the strategy is supported with real data, deadlines, and resources.

Financials and projections

Evaluating the risk-return profile of your venture and product, the financial side of the project demonstrates a startup's grasp of business and economics fundamentals and market realities. It is one of the most important factors for potential investors and can be a real deal-breaker.

Therefore, it is essential to meet these demands with controlled information. Present revenues, forecasts for three to five years, expenses, and cash flow based on explicit assumptions. Prioritize credibility and stay realistic, avoiding an overly optimistic tone.

The ask and use of funds

Another significant factor in your investment outcome is providing transparency in operations, funds, and asset allocation. Concentrating on your growth story is simply not enough. Your potential investors must trust you.

Allocate the next slide of the startup pitching to the detailed financial breakdown. First, define the investment amount you are seeking. Be realistic. Then specify how you are going to use these funds. Ensure the audience understands the assumptions behind the numbers.

Team: founders and key members

Do you want to include the key members and show your professionalism? On the next slide, you can reinforce your convincing game by impressing your audience with your expertise, knowledge, and skills.

Reveal the founders and key members who stand behind the idea. Show off your credentials and potential. Mention your track record, expertise, and commitment to demonstrate your passion and practicality. Remind them of your achievements to build confidence in their investment.

Vision for the future

Before introducing a clear call to action or your contact information, it is also vital to inform your investors of your long-term plan upfront. This way, you demonstrate future vision, which is attractive to potential financiers and shareholders.

Therefore, end your startup pitch deck with a long-term vision and mission. Show your ambition to grow and impact the market, build a strong brand identity, and address a pain point, inspiring investors to become an integral part of this movement.

How to Deliver a Successful Pitch Presentation?

Presenting your idea and convincing investors of its value is hard. It is not enough to create those 13 slides. Startups must master the art of persuasion by making a pitch deck that focuses on delivery, confidence, and an authentic, close, and transparent connection with potential investors. Here are several professional recommendations that might help you to do that.

Start pitch deck with a strong hook

A compelling hook is fundamental for creating a powerful first impression, drumming up interest, causing curiosity, and drawing the audience in. It breaks the ice and sets the tone for the entire presentation.

Therefore, open your presentation with an interesting story, a striking fact, startling statistics, an analogy, a metaphor, a scene, an illustration, or an anecdote. Ensure it captures attention in the first 30 seconds, generates positive reactions, and builds momentum.

Focus on clarity over jargon

The professional feel of the pitch deck is a key to successful fundraising. It builds credibility, inspires trust, earns respect, improves business prospects, and boosts the company's confidence. Follow these recommendations:

- Avoid jargon and slang unless relevant to the product and market segment.

- Prioritize clarity and transparency in message delivery.

- Use precise and straightforward language.

- Add only high-quality graphics and images.

- Ensure clarity and structure in every pitch deck slide.

Anticipate investor questions

When creating a winning pitch deck, the best strategy is to anticipate investors' questions, as potential stockholders will bombard you with them during and after the pitch. The readiness helps to maintain confidence and ensure clarity during fundraising discussions.

Therefore, prepare answers on competition, risks and threats, fund allocation, target market, growth, scalability, and product pros and cons. Refine responses with real-time data, statistics, and research.

Rehear and time the pitch

Practice refines everything, and creating a pitch deck is no exception. Even if you are confident in your presentation, rehearsal can surface hidden issues, inconsistencies, and timing problems that could ruin the overall impression.

It is highly recommended that you review your pitch deck and performance several times. This helps to perfect timing and make the delivery natural and confident. Ensure your presentation is no longer than 15 minutes and effectively highlights all the crucial details of the startup and its product.

Always tie back to investor value

Last but not least, the recommendation is to reinforce a startup pitch deck by tying it back to investor value. After all, the potential stockholders always act in their own interests.

Therefore, ensure every slide answers the question: "What's in it for the investor?" To that end, highlight ROI, growth, and exit opportunities. Avoid market noise in your message delivery. Show your passion and in-depth understanding of the market to demonstrate that you are a strong, serious business partner.

Essential Documents to Prepare After the Pitch

The startup deck presentation tells a story that investors must remember and, most importantly, provides strong reasons to open the conversation. However, a single presentation is not enough to answer all the concerns. Expect investors to bombard you with questions during the follow-up discussion. Therefore, ensure you have all the crucial material for them to review and support your answers. Here is what you need to have at your fingertips.

Comprehensive business plan

A business plan is perhaps the first thing that your potential investors might want to review. As a roadmap that outlines all the crucial details of a product launch and market entry, it fuels the marketing, branding, and advertising strategy. It also demonstrates the company's understanding of the real market, provides financial credibility, shows strategic thinking, and shows preparedness for challenges and risk management.

Therefore, ensure you have a detailed document outlining the strategy and its short—and long-term goals, as well as sensitive details such as revenue forecasts, cost estimates, and cash flow projections.

Financial model and projections

Undoubtedly, the business plan is the core of the follow-up discussion; however, when it comes to money, questions are getting more intricate and precise.

Ensure you have a dedicated document for the financial model and projections. It must include an economic evaluation of the product's feasibility and potential benefits, a cash flow statement, and analyses of revenue, costs, and scenarios.

Product demo, prototype, and early adopters

Written material is one thing, but showing a product in action is another. This is one of the most popular requests from potential customers and stockholders. Investors want to see the product in real life to understand how it could align with current market demands, preferences, and expectations.

Moreover, the working version helps build trust and credibility, demonstrates how it addresses customers' pain points, proves value, and creates a more tangible and memorable experience.

One-page executive summary

A one-page executive summary is a vital document that provides a concise yet informative overview of the business plan, the product's benefits and feasibility, the target audience, and the competition. It outlines everything shown in the presentation, helping decision-makers grasp the meeting's main points and reference it whenever they have concerns or questions.

As a rule, this document covers crucial details such as the problem or opportunity, the solution or product, business plan highlights, benefits, financial projections, and a clear call to action.

Legal documents: cap table and incorporation docs

Whether you hire one of the top branding companies or not, you must prepare legal documents. These documents establish the legal and financial framework and protect both parties. They are crucial for healthy, transparent investment, regulatory compliance, risk mitigation, formalized investments, and building confidence and credibility.

Be ready to provide the cap table, the company's equity distribution, the Rights Agreement, the incorporation documents, the company's structure, the investor's rights agreement, and the term sheet to ensure legal readiness for due diligence.

Best Pitch Deck Templates and Examples

Creating a successful startup pitch deck is a challenge, as you need to shape your story and value proposition to drum up interest and compel potential investors and customers to engage in follow-up discussions and become part of your journey. It is highly recommended that you explore proven deck templates and study successful pitch deck examples to better understand what it takes to create an effective pitch deck.

Famous startup decks examples: Airbnb, Uber, Facebook, Buffer

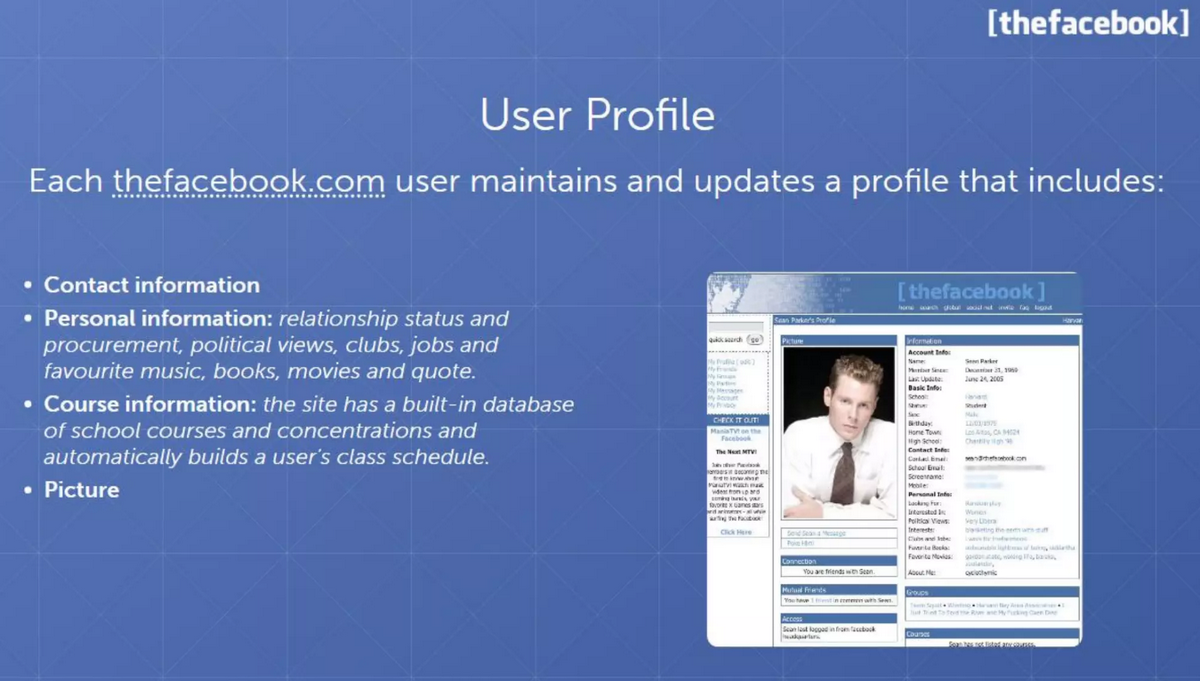

When it comes to getting real insights, there is no better way than to study famous startup decks. The web is teeming with examples—take Facebook and its original deck from 2004. It told the story of one of the world's most prominent and influential social media platforms.

This example was a staple of clarity, brevity, and originality as the team focused mainly on the platform's features, user engagement, customer base, and growth metrics. Every block was carefully selected to showcase the platform's potential.

Investor-recommended decks: Sequoia and Y Combinator

Along with studying examples, it is crucial to know your tools. Sequoia and Y Combinator are two of the most popular venture capital accelerators. The former is a leading platform for traditional investment operations with a long-term perspective and later-stage cycles. The latter is a platform for an early-stage fundraising cycle with mentorship, networking, and seed funding. Both are industry standards with VC-approved structures, strategic guidance, and frameworks.

As a rule, startups go first to Y Combinator and, after successful years of operation, seek a later-stage investment from Sequoia Capital.

Popular templates examples: Guy Kawasaki, Slidebean, Intercom

The good news for startups that want to create their pitch decks is that they do not have to do everything from scratch. There are presentation templates that help shape the idea, deliver the message, and present the offer in a pleasant, compelling, and impactful way. These ready-to-adapt mockups are great for structuring, creating reading flows, and meaningful experiences.

Consider Guy Kawasaki, Slidebean, and Intercom. They are among the most popular examples for delivering your idea, stimulating interest among potential customers, telling a story behind the brand, and building trust and credibility.

Industry-specific decks: SaaS, crypto, marketplaces

The success of a pitch deck largely depends on how well a startup meets the investor's expectations and vision. There are different types of markets and investor priorities.

This is why it is crucial to create presentations with the content, language, visuals, and messages tailored to the unique needs of the particular industry and market sector. Get a thorough understanding of SaaS models, Crypto, and marketplaces to make an informed decision with your message delivery and its content.

Conclusion

A startup pitch deck is a fundamental marketing tool designed to advance a business and give it a golden opportunity to secure the funds it needs or attract potential customers to bring its idea to life and enter the market with the finalized product or service.

It is not just a mere presentation with data and visuals. It is a platform to promote the startup, reflect its vision, mission, and goals, showcase the product, build trust and credibility, and inspire potential investors to partner.

To achieve its goal, the startup pitch decks must have specific slides and follow professional recommendations to tell a story that investors remember and are eager to participate in.

Oct 29, 2025